No one handles the Workers’ compensation insurance cases like the Workers Comp Kings. With ‘easy pay’ as you go through premiums and claims, you get assistance to experience the safety net of Workers Compensation from the top providers in case of any incidence.

On the other hand, business owners can breathe easy through Employers’ Liability Insurance. This safeguards the employers financially, and helps them solve the claim without making a hole in their pockets. Through Audit Reporting the insurance carrier Businesses can also save a substantial amount of money.

About Us Contact Us

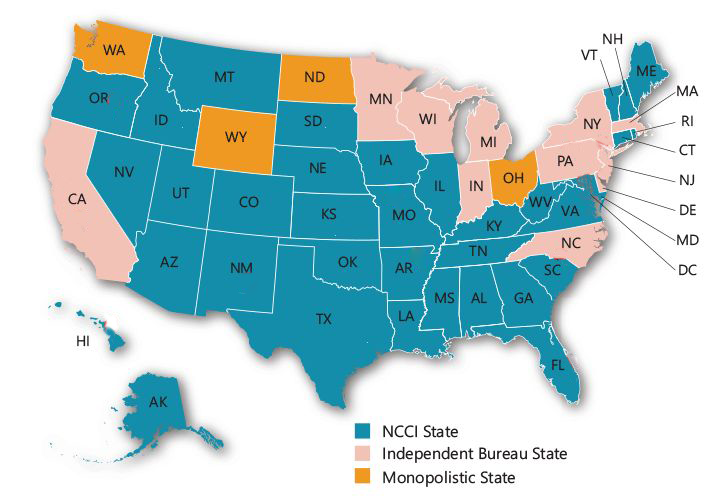

The National Council on Compensation Insurance (NCCI) has been around since 1923 and is headquartered in Boca Raton, Florida. NCCI is an insurance rating and data collection bureau for workers' compensation. The organization operates as a non-profit and is owned by its members. NCCI was established to maintain a healthy workers’ compensation system. In order to accomplish their mission, NCCI gathers data, analyzes industry trends, provides objective insurance rates, and offers loss cost recommendations to individual states and insurance companies.

Monopolistic State Funds jurisdictions are where an employer must obtain workers compensation insurance from a compulsory state fund or qualify as a self-insurer (as is allowed in two of the jurisdictions). Such insurance is not subject to any of the procedures or programs of the NCCI. Instead, each jurisdiction has its own rules and regulations that govern the placement and administration of workers compensation insurance. The following states/jurisdictions are monopolistic fund states: North Dakota, Ohio, Washington, Wyoming, Puerto Rico, and the U.S. Virgin Islands.

There are 11 Independent Rating Bureaus in the US that were created by their state-specific statutes. These states are: California, Delaware, Indiana, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Carolina, Pennsylvania, and Wisconsin. NCCI works closely with many of the Independent Bureaus on a contract basis to provide various services such as data collection, actuarial and rate filing support, residual market administration and auditing, manuals and rules.

The Workers’ Compensation Insurance Rating Bureau of California (WCIRB) is a private, nonprofit association of insurance companies licensed to transact workers' compensation insurance in the state of California. The WCIRB collects and validates classification data for all California policyholders. This data is critical to ensuring that policyholders engaged in common industries are similarly classified. It is also key to the publication of accurate experience modifications and the use of the data for ratemaking.

The quote process is quick, simple and frankly it looks amazing from here. Answer a few quick questions for underwriting compliance and we will be off and running to bring your case to the top insurance carriers out there. We find you the best rates in the industry for your business.

Know MoreCopyright © 2026 Laurence Taylor. All Rights Reserved.